Table of Contents

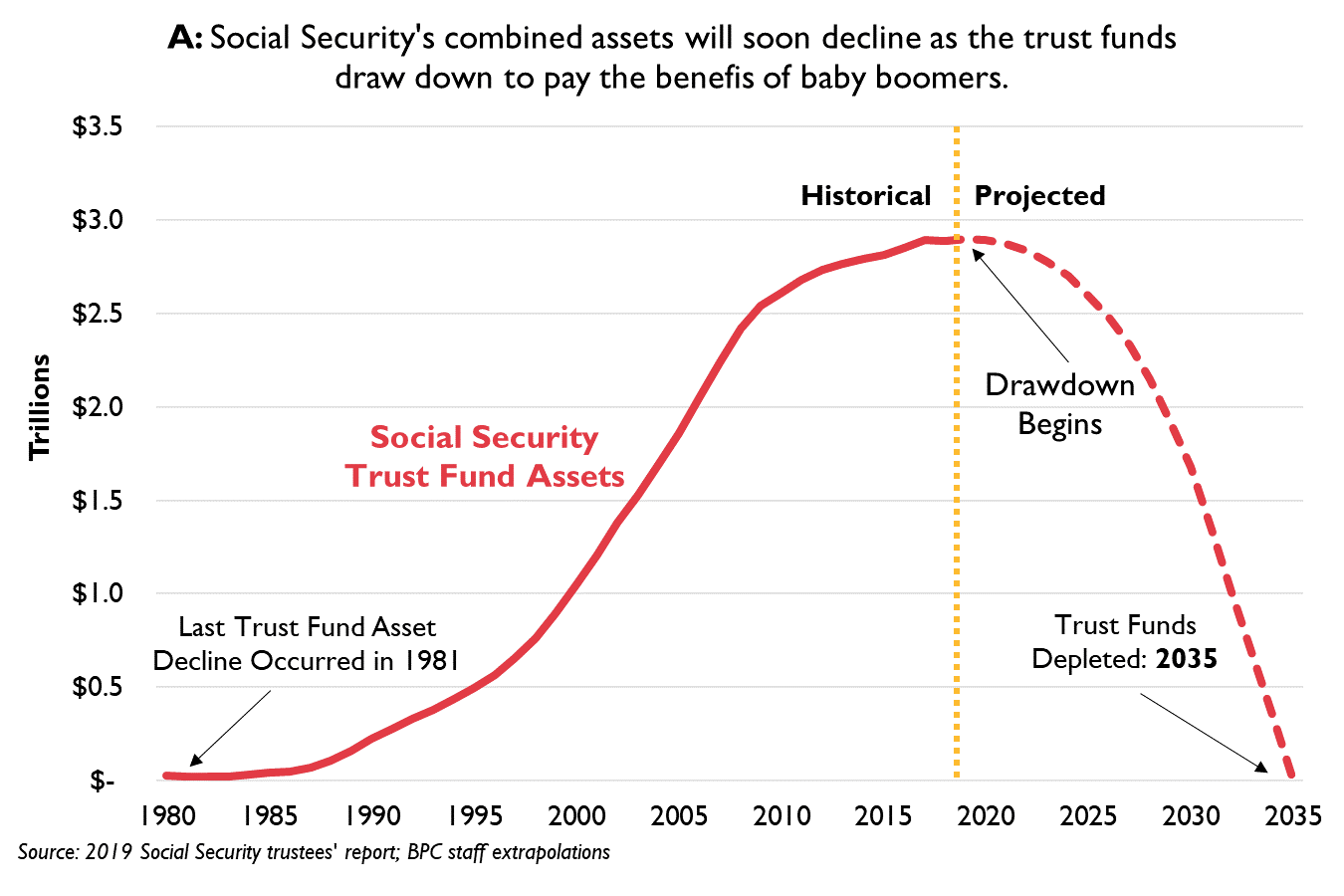

- Understanding the New Social Security Projections in Five Charts ...

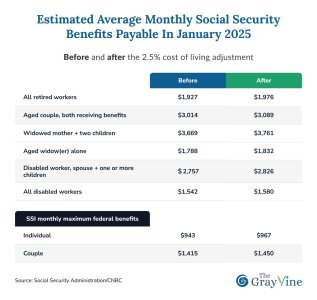

- 2025 Social Security check sizes to be revealed soon—what you need to ...

- Treasury Inflation-Protected Securities | TIPS: Perfect investment for ...

- Social Security Max Income Allowed 2024 Chart - Dede Monica

- 3 SURPRISES About 2025 Social Security Increase | SSA, SSI, SSDI ...

- Here Are the 2025 Social Security Earnings-Test Limits

- 2025 Estimated COLA - Social Security Increase! How much will it be ...

- WOW! 5 BIG CHANGES Coming To Social Security in 2025 | SSA, SSI, SSDI ...

- Sss Contribution Table 2025 - Betty Chelsey

- 2025 Tax Brackets Vs 2025 Calendar - Benni Magdalene

What are Federal Income Tax Rates and Brackets?

2022 Federal Income Tax Rates and Brackets

How Federal Income Tax Rates and Brackets Work

To illustrate how federal income tax rates and brackets work, let's consider an example. Suppose you're single and have a taxable income of $50,000. Using the 2022 tax brackets, you would fall into the 22% tax bracket. However, you wouldn't pay 22% on the entire $50,000. Instead, you would pay: 10% on the first $9,875 12% on the amount between $9,876 and $40,125 22% on the amount between $40,126 and $50,000 Your total tax liability would be the sum of these amounts. Understanding federal income tax rates and brackets is crucial for managing your finances and minimizing your tax liability. By knowing which tax bracket you fall into and how much tax you owe, you can make informed decisions about your income and investments. Remember to consult the IRS website or consult with a tax professional to ensure you're taking advantage of all the tax deductions and credits available to you. With this guide, you'll be better equipped to navigate the complex world of federal income tax rates and brackets.For more information, visit the Internal Revenue Service website.